Go for the Green: Equipping financial literacy through alumni, faculty and student engagement

December 15, 2023 - Katie Frey

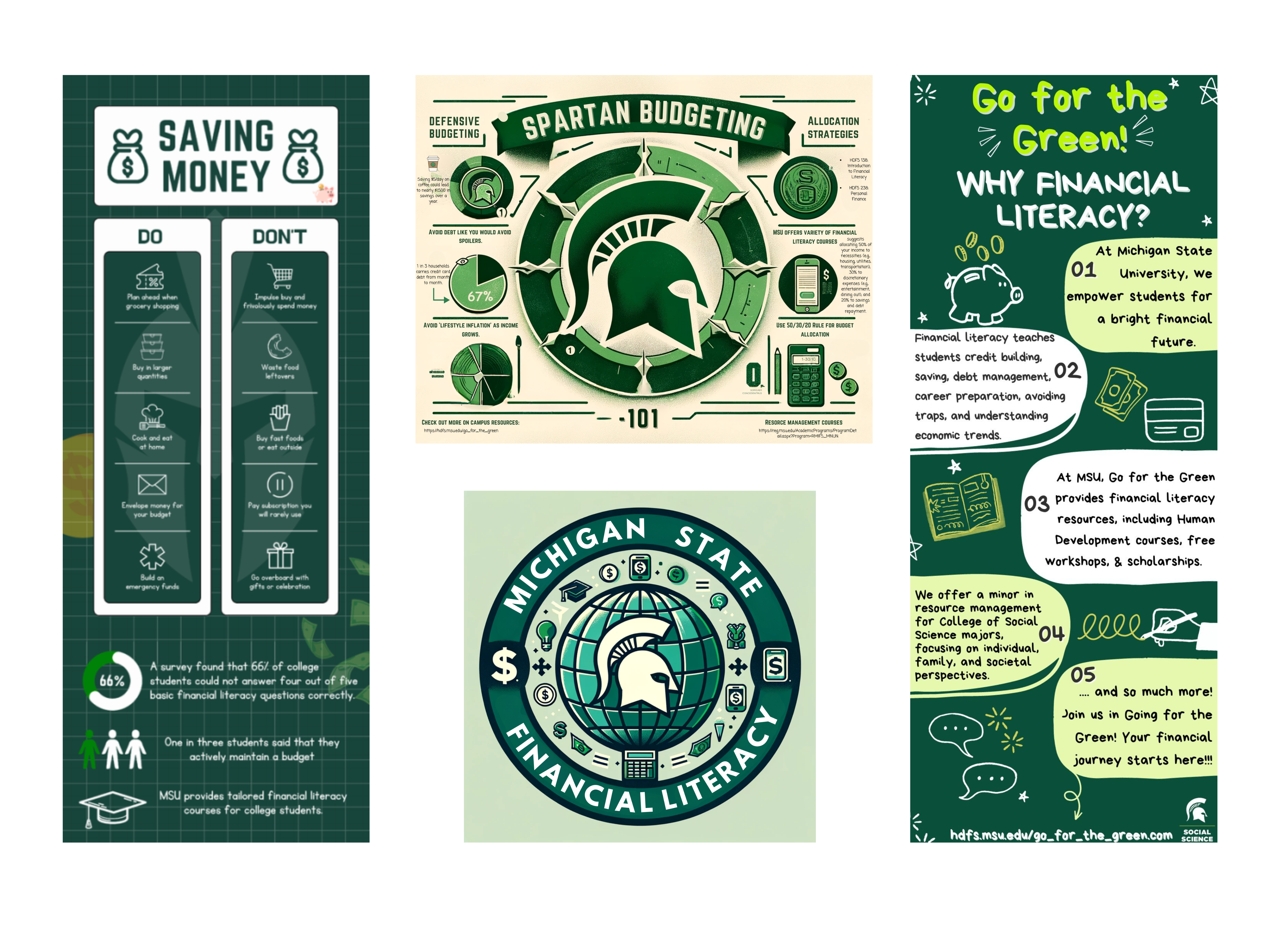

Graphics created by Maddie Shlaimoon and Tushar Thakur, recipients of the Go for the Green Paul Pradel Financial Literacy Ambassador Scholarship.

Recently, Maddie Shlaimoon and Tushar Thakur, two MSU College of Social Science students, were awarded funding from the Go for the Green Paul Pradel Financial Literacy Ambassador Scholarship. The students were selected based upon their creation of a social media ad campaign describing the importance of financial literacy and the programs at MSU, and they each will receive $1,500 from the scholarship fund gifted by MSU alumnus Paul Pradel.

From left to right: Maddie Shlaimoon and Tushar Thakur, recipients of the Go for the Green Paul Pradel Financial Literacy Ambassador Scholarship. Photos courtesy of Maddie Shlaimoon and Tushar Thakur, respectively.

Maddie Shlaimoon is a junior, majoring in human capital and society.

“Receiving this scholarship has inspired me to work even harder to bring the campaign to life,” Shlaimoon said. “I am committed to making a meaningful contribution to the financial education of MSU students, and your support is instrumental in achieving this goal.”

Tushar Thakur is a sophomore majoring in economics.

“This scholarship is not just a financial boost but also a source of encouragement for me,” Thakur said. “It strengthens my ability to excel academically and to contribute more towards the university community. I am excited about the opportunities that this award will enable me to pursue, particularly in my field of study.”

Three students were also selected as finalists for their submission of their “Why Financial Literacy” videos. Parameswar Nair, first year computer science student; Hayleigh Atkin, kinesiology senior; and Matthew Dorado Farietta.

What is financial literacy and why does it matter to college students?

Financial literacy is understanding and managing your personal finances and developing practices that support your financial health such as budgeting, renting versus buying, student loans, investing basics and comparing compensation and benefits.

“No matter what you do for a career-- whether a school teacher, software developer, hockey player or project manager-- you're going to get paid. And just like building healthy physical and mental habits, if you don't figure out how to build healthy financial habits, you will risk going in the wrong direction,” said Paul Pradel, MSU alumnus, financial planner and sponsor of the scholarship. “So I think it's critical to get in front of young people and help to encourage the idea of financial wellbeing and literacy.”

Paul Pradel is the owner of Pradel Financial Group whose mission is to help professionals and executives financially prepare, plan, and save for their future. Alongside his career in financial planning, Pradel is also passionate about the importance of helping young adults develop a solid financial foundation. Since 2018, Pradel has given his time and resources to scholarship funds and as a guest speaker for MSU classes and groups.

Paul Pradel speaks to incoming first-year students at the MSU College of Social Science Colloquium. Photo courtesy of Jackie Hawthorne, College of Social Science.

“In every class, there'll be a question along the lines of: Is it worth it if all I can save is $10-50 a month? And my answer is: Is it worth it to start lifting weights when you can only lift ten-pound weights?” Pradel said – and he is known for his strength in communicating through stories and metaphor. “You’ve got to start with something. With physical fitness, as you gradually lift weights, you’ll build muscle, and then be able to increase the weight. It’s the same with saving, and if you build that financial muscle, you build the saving habit, and as you earn more, you’ll be able to increase the amount of that saving habit you’ve already created.”

A nontraditional, alumnus journey and giving back

Pradel was 17 in 1984 when he came to MSU, first declaring accounting as his major.

“I went to my accounting meeting, and all these guys had suits on and I didn't, they all looked really buttoned up. And I go, that profession doesn't interest me,” Pradel remembered.

He switched to communications, but still didn’t find it was the right fit, leaving MSU after two years of being in school.

“I would describe myself at that time as just a young guy, maybe too young to really know. And in those first two years, I took advantage of the campus and I enjoyed my experiences, but I felt rudderless,” he reminisced. “But my second experience at Michigan State when I came back, I had had five years of working. I had real world experience and I had met some people along that five years off who really loved their college experience. And I admired them, so I came back saying I need to soak this up, I need to take advantage of everything that I possibly can that the campus offers. And I came back with a very different experience. It was like two different people went to Michigan State.”

Pradel graduated in 1993 with a multidisciplinary degree from the MSU College of Social Science with focus areas of anthropology, philosophy and psychology.

And he didn’t take one finance class. But upon graduation, Pradel remembers fondly how his stepfather encouraged him to try financial advising at his firm when Pradel's largest hesitation was wearing a suit.

“If you do this, you'll have to wear a suit for a while because you're going to work for a firm,” his stepfather replied. “But then if you decide to open your own firm, you can wear whatever you want.”

And that was what he did, Pradel spent 10 years wearing suits at a firm where he trained and received accreditation for the profession. And then he left to open his own financial planning business where he sits in an office, surrounded by posters and records, not a suit in sight. He loves his profession for the chance it offers him to make a difference in people’s lives and to build relationships. He says his favorite parts of his career is helping people reach their financial goals and the relationships they build along the way.

“I view my position as being our clients’ personal CFO. Our clients are individual couples, partners, parents, grandparents, and I take care of their financial well-being. I can't be prouder of what we've built. From a kid who went to Michigan State who was unsure and dropped out and then came back still unsure, and then the ‘I don't want to wear a suit conversation.’ And 31 years later, I run a very successful financial planning business and I have relationships with awesome clients. That's cool stuff.”

With his pride for the business he has built, he also has passion for giving back to MSU because of the people. He was introduced to Dr. Erica Tobe and asked to give a presentation for her personal finance class, HDFS 238.

During his first class presentation, he had created a slide deck in the scenario of the dreaded crickets. But what happened hooked him: one hand went up after another.

Paul Pradel presents in HDFS 283 Introduction to Personal Finance. Photo courtesy of Paul Pradel.

“The questions were, ‘What's a good way to build credit? Or hey, if you had $10, can you do anything with that? Or do you have any advice for you know, when I get out do I want to rent or buy? How important is the 401k?’ He even had some questions on what to look for in a career. In other words, they went beyond anything he expected. An hour and 20 minutes later, I never even got to my second slide.” Paul said he was hooked from that moment and has joined many classes since, all with the free flowing approach to answer questions.

A few months ago, Pradel spoke in that same HDFS 238 Personal Finance course of over 400 students and then met with the MSU Hockey Team. And now his email and text message inboxes are filled with questions from students.

Pradel’s generosity with his time and resources has been helping to grow the financial literacy program and awareness at MSU.

“Paul does a dynamic job of not only talking about the field, talking about the discipline, but then also appealing to students and talking about his journey as an alum here at Michigan State. He discusses his journey in the field, what he's doing now and how he's used the College of Social Science background to be a framework for his field in his career,” said Erica Tobe, Ph.D., extension specialist with MSU Extension and assistant professor in the Department of Human Development and Family Studies (HDFS), home of MSU’s Go for the Green Financial Literacy Program. “Paul has now worked with at least six or seven of our courses, where he's come in and presented. He's just a wonderful partner and he's done a great job of helping us grow the program through his passion and knowledge, and his financial gifts to support and grow our program.”

College of Social Science alum Paul Pradel speaks to an MSU class about personal finance. Photo courtesy of Paul Pradel.

“I would like to extend my heartfelt thanks to Mr. Paul Pradel,” Thakur said upon receiving the award. “Your generosity and commitment to helping students is truly inspiring. It is reassuring to know that our alumni network actively supports and invests in the future of students like myself.”

A passion project from the sides of their desks: how financial literacy programs are growing at MSU

Amanda Guinot-Talbot, Ph.D., will never forget that moment when she and Dr. Tobe were HDFS graduate students and their supervisor asked them to take over teaching HDFS 238 Introduction to Personal Finance.

“At that time, it was one of our biggest, most popular, most successful courses,” she recalled. “I don't think either of us felt prepared to do it. And we just sat there in shock and awe,” she reminisced. “And then we made plans to begin teaching 238, and then to get the word out broadly across campus about financial literacy and this program.”

From left to right: Drs. Erica Tobe and Amanda Guinot-Talbot.

Dr. Erica Tobe and Dr. Amanda Guinot Talbot began teaching HDFS 238, Introduction to Personal Finance, with 250 students in one section, and they have now added additional instructors and expanded the class to two sections each semester.

“We talk about budgeting, goal setting, credit, student loans, buying a car, renting an apartment or buying a house, doing your taxes, and thinking about investments in retirement. Everything that you need to know to be an adult, basically, is the focus,” Dr. Tobe explained.

Additionally, they work with campus partners such as MSUFCU and alumni to put together programs and bring in guest speakers for other outreach events. They are trying to reach more students by infusing financial literacy into student engagement events on campus.

“In the college, we’re really looking at students’ overall health and wellbeing, and financial health is a tremendous part of that,” Dr. Tobe said. “Especially now that many students are graduating with on average over $20k of debt. We want our students to be healthy, well balanced, and have good financial wellbeing. I think it's an interest of many of our alums, too. So, whether they are entrepreneurs, or HR professionals, or economists, we have all of those tremendous leaders in our college, and financial literacy is a passion for many.”

In addition to their HDFS 238 course and their presence at outreach events , the MSU College of Social Science has introduced a new minor in resource management for students interested in a career either in the for profit or non-profit sector that utilizes financial education.

“In addition, we offer a two credit course aimed at freshmen and sophomores, HDFS 138 - Introduction to Financial Literacy, which focuses on the content needed to be financially successful while a student in college,” Dr. Guinot-Talbot said.

In the future, they hope to continue to expand their reach through their HDFS courses, and also through partnerships and campus-wide events.

“Looking ahead, we’re really hoping for growth for the support of our students, growth for our outreach, and philanthropy,” Dr. Tobe said.

To learn more about Go for the Green Financial Literacy resources and course offerings, visit https://hdfs.msu.edu/go_for_the_green.

To learn more about giving to support this effort, please contact Alex Tripp, actripp@msu.edu.